Monthly Newsletter

Monthly Newsletters

March 2024

Forthcoming Legislation – Employment Law Updates April 2024

Minimum Wage Increases from April 2024

The Government has announced the National Living Wage (NLW) and National Minimum Wage (NMW) rates which will apply from 1 April 2024. The NLW will be extended to 21 and 22-year-olds for the first time (having previously applied to those aged 23 or older).

The new rates will be as follows:

• the NLW (for people aged 21 or older) will increase from £10.42 to £11.44 per hour

• the 18–20-year-old rate will increase from £7.49 to £8.60 per hour

• the 16–17-year-old rate will increase from £5.28 to £6.40 per hour

• the apprentice rate will increase from £5.28 to £6.40 per hour

• the accommodation offset will increase from £9.10 to £9.99 per day.

Occupational and Personal Pension Schemes (General Levy) (Amendment) Regulations 2024

Effective from 1st April 2024, these regulations introduce new rates that will be used to calculate the general levy payable by occupational and personal pension schemes.

Having consulted on options for mitigating the ongoing deficit in levy funding, the Government has decided to retain the current levy structure and increase rates by 6.5% per year for all schemes.

The general levy recovers the core running costs of the Pensions Regulator and the Pensions Ombudsman. It also covers those aspects of the Money and Pensions Service (MaPS) which relate to general pensions guidance and elements of the pensions dashboard.

Maternity Leave, Adoption Leave and Shared Parental Leave (Amendment) Regulations 2024

These regulations bring into force the Protection from Redundancy (Pregnancy and Family Leave) Act 2023, extending the period of special protection from redundancy for employees who are on maternity, adoption or shared parental leave to 18 months after birth or adoption, and to during pregnancy.

Under current laws, if employees on maternity, adoption or shared parental leave are at risk of redundancy, employers must offer them suitable alternative employment where a vacancy exists, giving them priority over other redundant employees. However, the employer’s obligation ends once the employee has returned to work. As a result, some employers wait until an employee has returned to work from a period of family-related leave before making their job redundant.

Under the new legislation, the obligation to offer suitable alternative employment would be extended to apply to pregnant employees and those who have recently returned from a period of family-related leave. The extended protection period would cover from when an employee tells their employer they are pregnant until 18 months after the birth. The 18-month window ensures an employee returning from a year of maternity leave would receive six months’ additional redundancy protection.

For adoption, the protected period would cover 18 months from placement for adoption. And, for shared parental leave, the protected period would cover 18 months from birth provided the parent had taken at least six consecutive weeks of shared parental leave. Parents taking shared parental leave could not claim this protection if they were already covered by the legislation due to pregnancy or adoption.

Subject to parliamentary approval, the extension to the protected period will apply where the employer is informed of the pregnancy, birth or placement for adoption on or after 6 April 2024.

For our retained clients: You will shortly receive an updated policy via email for your Employee Handbook to reflect these changes.

Flexible Working Regulations Amendment

These regulations amend the Flexible Working Regulations 2014 so that the right to make a flexible working request applies when an employee begins employment. They remove the current requirement for employees to have been continuously employed for 26 weeks before making a flexible working request and thereby make the right to request flexible working a “day one right”.

The requirement for 26 weeks’ continuous employment will not apply to flexible working requests made on or after 6 April 2024.

Other changes to flexible working legislation are contained in the Employment Relations (Flexible Working) Act 2023, which will be brought into force via separate regulations that are also expected to be effective from 6 April 2024.

For our retained clients: You will shortly receive an updated policy via email for your Employee Handbook to reflect these changes.

Carer’s Leave Regulations 2024

These regulations set out the statutory scheme under which employees can apply for up to one week of unpaid carer’s leave per year in order to provide care or assistance to someone dependent upon them who has a long-term care need. The new right to carer’s leave is introduced by the Carer’s Leave Act 2023 and the Carer’s Leave Act 2023 (Commencement) Regulations Act 2023.

Eligible employees will have a “day-one” right to carer’s leave. The right will apply to employees who have a dependant with a long-term care need and want to be absent from work to provide or arrange care for that dependant.

The employee will be entitled to take at least one week’s leave in any 12-month period. The leave could be taken flexibly in individual or half-days.

The regulations set rules around notice and postponement of carer’s leave. Employees will be required to give written notice of their intention to take carer’s leave — confirming their entitlement to take it and giving notice periods as specified in the regulations. Evidence of entitlement to take the leave will not be required.

Employees taking carer’s leave will have the same employment protections as those taking other forms of family-related leave, including protection from dismissal or detriment as a result of having taken the leave.

For our retained clients: You will shortly receive an updated policy via email for your Employee Handbook to reflect these changes.

Employment Rights (Increase of Limits) Order 2024

The increases to tribunal award limits from 6 April 2024 are set out in the Employment Rights (Increase of Limits) Order 2024.

• The maximum compensatory award for unfair dismissal increases from £105,707 to £115,115. (The award is capped at the lower of this maximum figure or 12 months’ pay.)

• The minimum award of compensation for dismissal on trade union, health and safety, occupational pension scheme trustee, employee representative and working time grounds only increases from £7836 to £8533.

• A week’s pay for the purpose of calculating the basic award for unfair dismissal and redundancy payments increases from £643 to £700.

• The daily rate for guarantee pay increases from £35 to £38.

The increases apply where the event giving rise to the entitlement to compensation or other payments occurs on or after 6 April 2024.

National Insurance Contributions (Reduction in Rates) (No. 2) Bill

This Bill introduces a cut in the main rate of primary (employee) Class 1 National Insurance contributions (NICs) from 10% to 8% and a cut in the main rate of self-employed Class 4 NICs from the previously announced rate of 8% to 6%.

The reduction in Class 1 NICs to 8% was legislated in the National Insurance Contributions (Reduction in Rates) Act 2023.

The Bill is being fast-tracked to receive Royal Assent before the current parliamentary session ends on 26 March 2024.

For further support and advice on any of these Employment Law updates, please contact The HR Team.

February 2024

Skilled Worker Visas – what rules are changing?

The Government has announced plans to cut net migration numbers into the UK. Several changes are set to be introduced from spring 2024 that employers need to be aware of when employing, or in some cases continuing to employ, foreign nationals.

Background

The Government has announced a package of proposals designed to cut net migration numbers into the UK, to halt what the Home Secretary, James Cleverly, has said is a “…drastic rise in our work visa routes…” as net migration is “…far too high”. These plans are designed to “…crack down on those who seek to take advantage of our hospitality”.

According to the Government’s calculations, 300,000 people who came to the UK in 2022 would not have been able to do so under the plans it has now proposed. In response to concerns that this would leave the UK without access to a valuable pool of potential workers, the Government is prioritising growing the domestic workforce through the Back to Work Plan, designed to provide employment-focused support that will help people stay healthy, get off benefits and move into work.

Visa changes

First, there are plans to increase the annual salary required to receive a UK skilled worker visa from £26,200 to £38,700. This is to stop immigration from, according to the home secretary, undercutting the salary of British workers. However, those coming on the health and care visa route will be exempted from the increase to the salary threshold for skilled worker visas.

The Government will also increase the minimum income required for British citizens and those settled in the UK who want their family members to join them, which Mr Cleverly has said is to ensure that people only bring dependants whom they can support financially. Initially, the Government announced that they would raise the minimum income for family visas to the same threshold as the minimum salary threshold for skilled workers (this would have meant an increase to £38,700 from £18,000). However, they have since announced that the intention is to raise the minimum income for family visas incrementally, in stages, “to give predictability to families”. In Spring 2024, therefore, the threshold will increase to £29,000, which is the 25th percentile of earnings for jobs at the skill level of the Regulated Qualifications Framework (RQF3). The Home Office intends to increase to the 40th percentile (currently £34,500) and then to the 50th percentile (currently £38,700) at a date to be set in the future.

Dependants will also be prevented, from January 2024, from joining international students in the UK unless they are on postgraduate courses designated as a research programme. The health and care visa rules will also be tightened up by preventing overseas care workers from bringing their dependants to the UK. In addition, care firms in England must be regulated by the Care Quality Commission (CQC) in order for them to sponsor visas, which is hoped to crack down on bogus care firms sponsoring individuals with no intention (or even means) to provide them with work.

Finally, in relation to visa changes, the Government will end the 20% going rate salary discount for shortage occupations and replace the Shortage Occupation List with a new Immigration Salary List, which will retain a general threshold discount.

In response to these proposals, Chief Executive Officer of Care England, Professor Martin Green, said: “If the Government now wants to move away from international recruitment as the solution to fixing the social care workforce crisis, it must act swiftly and invest in improving the pay and conditions to drive domestic recruitment.”

Illegal working penalties

In the biggest change to civil penalties since 2014, fines are to be more than tripled for employers who allow illegal migrants to work for them. Announced during Suella Braverman’s time as home secretary, the penalty for employers, last increased in 2014, will be raised to up to £45,000 per illegal worker for a first breach from £15,000 and up to £60,000 for repeat breaches from £20,000. A consultation will also be opened in the future on options to strengthen action against licensed businesses that are employing illegal workers.

Employers should already be checking the eligibility of anyone they employ. If the individual has a time-limited right-to-work entitlement, as is the case with many types of Visa, follow-up checks will be needed to ensure this is renewed.

There are several ways to check right-to-work eligibility, which are not changing, including via a manual check of original documentation and a Home Office online checking system. Below, we outline what these are.

Carrying out right-to-work checks

Right to work checks should always be completed before employing someone new, regardless of their country of origin. Follow-up checks may also be necessary during employment. If completed correctly, employers will establish a continuous statutory excuse for the duration of that person’s employment, providing a defence should it later turn out that the individual’s right to work was not genuine. These checks should be carried out in the time immediately prior to their employment starting, because an individual’s right-to-work status can change over time.

Checks can be carried out in the following ways-

• Manually.

• Online.

• Digitally.

The following checks can be completed for British and Irish citizens-

• A manual document-based check.

• A digital check using Identity Document Verification Technology (IDVT) via the services of an Identity Service Provider (IDSP).

The validity of the documents must be checked in the presence of the holder, either physically or via video link, and the employer must be in physical possession of the original documents. Alternatively, employers can conduct a digital check using IDVT via the services of an IDSP.

The following checks are available for all other nationalities-

• A manual document-based check.

• An online check using the Home Office checking service.

A record must be kept of all checks that are carried out and retained for at least the duration of the individual’s employment.

Conclusion

The rules around employing foreign nationals are set to change once again next year, and employers will need to be prepared where the changes impact on their current employees and their future recruitment plans.

Now is also the time to review any internal right-to-work checking processes to ensure they are fully compliant with the law and provide the organisation with the statutory excuse. Failing to ensure these checks are correct can be a very costly mistake and therefore taking the time to review these processes is worthwhile.

For expert advice and guidance with your Company’s skilled worker visa application process, contact The HR Team.

January 2024

What does a leap year mean for employers?

29th February does not come around very often; only every four years in fact. And this year, 2024, is one of those years. But what difference does it make for employers, and will it mean workers need to be paid an extra day’s pay? This month, we look at leap years and their implications in the workplace.

Background

Every four years, there’s an extra day at the end of February. It’s called a “leap day” and it means that February becomes 29 days long, and the year becomes 366 days long. This year, it’s on a Thursday.

Leap years exist because a single year in the Gregorian calendar is slightly shorter than a solar year, or the amount of time it takes for Earth to completely orbit the sun once. A calendar year is exactly 365 days long, but a solar year is roughly 365.24 days long, or 365 days, five hours, 48 minutes and 56 seconds. Failing to account for this difference would mean that for each year that passes, the gap between the start of a calendar year and a solar year would widen by five hours, 48 minutes and 56 seconds. Over time, this would shift the timing of the seasons which would impact on many aspects of day-to-day life.

What it means for employers

Workers may ask if they get paid for an extra day in a leap year. It is an extra day, after all, and with it being on a Thursday this year, many will see it as an additional working day. However, the answer isn’t as simple as that. It all depends on their pay structure.

Hourly paid workers

In the case of an hourly paid worker who has a pay reference period of one week, i.e. they’re paid weekly, they will not see any actual difference in their pay because the number of days worked in their pay reference period has not changed — a leap day does not mean a seven-day week becomes an eight-day week, so these workers will have worked their usual hours.

When it comes to an hourly paid worker with a pay reference period of one month, i.e. they’re paid monthly, they will see an increase because the number of days worked in the pay reference period has changed; they will work for 21 days in February rather than the usual 20 days. Therefore, they are owed an extra day’s pay because they have worked an extra day.

Salaried workers

Salaried workers will not see any difference in pay because they are paid with reference to the year and not the hours worked. However, for workers who are paid at the National Living/Minimum Wage, it’s worth running a compliance check to make sure there are no breaches around the leap day.

Leap day and key dates

Pay day

Where employees are paid on the last day of the month, this can mean workers are paid their February pay a day later than is usual, which could have significant consequences, particularly for those living on a tight budget. Employers should therefore decide whether they will still pay on day 28 or follow the contract and pay on day 29. Whichever way is decided upon, it should be confirmed to employees in time for them to put any necessary plans in place.

Statutory sick pay

For employees who go off sick in the final days of February, when processing payroll, the extra day will need to be considered when counting waiting days, which could affect when payment begins.

Deadlines/meetings

Recurring deadlines and meetings are a normal part of working life. They can help with managing employee workloads and making sure important tasks are completed in a timely manner. However, care must be taken to ensure these are not impacted by there being a 29 February this year. Checking in advance can help to avoid any mistakes when the time comes.

Notice

Lots of things in employment law operate with reference to a number of days, and employers will need to identify if this will impact any of their employees.

First, employers will need to remember to factor in the extra day in the month when giving someone termination notice in terms of days. Otherwise, it could mean that an individual whose employment is scheduled to end on 1 March, when in fact it should be 29 February, is given an extra day’s pay.

The same applies where employees request annual leave (where the employer requires a certain number of days’ notice), parental leave (which needs 21 days’ notice of the start date of the leave), paternity leave (which must be taken within 56 days of the birth), etc. Day 29 needs to be remembered here otherwise a request could be denied on the basis that correct notice hasn’t been given when it has. Remember also, anything that gives a date range such as “27 February–3 March” is six days, when it would be five in non-leap years.

Takeaways

For many employers, they will not be affected by the leap year. However, for those that are, any decisions made relating to this should be communicated to employees to ensure everyone is treated fairly and consistently.

For expert knowledge and support with any HR query, contact The HR Team Team today.

What is protected notice pay?

‘Protected’ notice arises when an employee is dismissed, or resigns, and the following circumstances apply:

• They are ready and willing to work but no work is available (e.g. a lay off situation)

• They are incapable of work because of sickness or injury

• They are absent from work because of pregnancy or childbirth, or on adoption parental or paternity leave (exercising their right to family friendly leave)

• They are absent from work due to holiday.

Where this is the case, and their notice period is the same or not more than a week more than the minimum notice required by the Employment Rights Act 1996 (i.e. a week for every year of service, to a maximum of 12), then ‘protected notice’ applies. This means that rather than being paid what they normally would be paid for the type of leave they are on during the notice period, such as maternity pay, sick pay, or nothing if there is a lay off situation, they would instead get full pay for the entire notice period.

For example, if an employee is off sick, and only paid statutory notice, the protected notice rules apply and they should receive full pay for the duration of their notice period. This can be made up of sick pay and normal pay; there is no requirement to pay their full pay and sick pay on top of that.

For pragmatic advice and friendly, down-to-earth HR support, contact The HR Team today.

Government publishes draft Paternity Leave Regulations

The Government had committed to amending the current legislation on parental leave following a consultation to which it had received 185 responses. Now it has published a draft Statutory Instrument (SI), the Paternity Leave (Amendment) Regulations 2024.

Although the adopted version of this SI has still to be published, none of the main terms are likely to be changed before it comes into force on 8 March 2024.

The draft regulations set out changes to the way in which the statutory entitlement to paternity leave is exercised. The amendments make changes to requirements relating to notice and evidence, the period within which paternity leave must be taken, and the existing requirement that paternity leave be taken in one continuous period.

The main changes include the following-

- Amendments will take effect in relation to children whose expected week of childbirth is after 6 April 2024, and children whose expected date of placement for adoption, or expected date of entry into Great Britain for adoption, is on or after that date.

- Provision is made for situations where an employee has served a notice or provided information or a declaration under the provisions in force prior to the coming into force of these regulations. The employee will be deemed to have complied with any requirement in the amendments in these regulations to provide that information, declaration or notice.

- An employee will be allowed to choose to take either two non-consecutive weeks’ paternity leave (birth), or a single period of either one week or two weeks. The period in which paternity leave (birth) must be taken is extended from 56 days after the birth of the child, to 52 weeks after the birth. Similar amendments are made in respect of paternity leave (adoption).

- Details are given of the notices and evidence of entitlement an employee must give to an employer in order to take paternity leave (birth). This includes a provision for an employee to vary any leave dates notified previously. Similar provision is made in relation to paternity leave (adoption).

For help with amending your Family Friendly Policy this year, in order to remain up to date with Employment Legislation changes, contact The HR Team today.

December 2023

How to retain your best employees in 2024

As the challenges of recruitment intensify and employee expectations rise, business leaders must adopt strategic thinking to retain their top talent in the coming year.

The current landscape, marked by a global pandemic, the Great Resignation, and a phenomenon known as “quiet quitting,” signals a significant recalibration in how people integrate work into their lives. Despite record rates of quiet quitting and job transitions, a substantial number of employees express dissatisfaction, creating a fertile ground for pursuing employment upgrades—a narrative echoed worldwide.

In order for companies to achieve their overall business goals for 2024, business leaders must focus on how to retain their best employees. Achieving this involves cultivating commitment within the workforce, a task highlighted by numerous studies on retention and turnover. Success hinges on excelling in three crucial aspects of the employee experience. In the post-Covid era, employees remain loyal and psychologically engaged when they secure their ideal job, engage in meaningful work, and work under the guidance of a great leader.

What can you do as a business leaders and how HR can contribute to shaping these experiences within your organisation?

• Ideal Job:

To define an ideal job, employees assess three key factors: pay, workload, and flexibility. Employees across the world now demand higher wages, reject the hustle culture, and prioritise flexibility—the most sought-after workplace benefit globally. Adequate compensation, a challenging yet manageable workload, and flexibility in when, where, and how they work significantly impact long-term commitment. To enhance this dimension, leaders must innovate compensation structures, optimise workloads through staffing adjustments, and offer benefits that outshine competitors. Continuous efforts to elevate wages and empower workers with more control over their work experience contribute to organisational loyalty.

• Meaningful Work:

The meaningful work dimension centres on the daily work experience, focusing on three key elements: purpose, strengths, and belonging. Employees seek a sense of purpose in their work, aligning their strengths with job responsibilities while feeling accepted within a team. Commitment flourishes when employees believe their work has a meaningful impact. To enrich this experience, leaders should articulate the societal significance of their company’s work, invest in job crafting to align roles with individual talents, prioritise professional development, foster camaraderie among team members, and create an inclusive workplace. These actions collectively contribute to employees finding meaning in their daily tasks.

• Great Leadership:

The third dimension revolves around the individuals overseeing day-to-day work—direct managers. Research highlights the pivotal role of leaders in shaping the employee experience, with managers influencing engagement levels significantly. Effective leadership involves coaching, building trust, and advocating for employees’ best interests. Managers who consistently engage in coaching conversations, earn and grant trust, and advocate for their team members foster positive work experiences. Elevating the great leadership factor necessitates investments in leadership development and management training, creating platforms for leaders to collaboratively address challenges, and upskilling in communication skills. Establishing a people-first culture that prioritises wellbeing further reinforces leadership excellence.

These three dimensions—ideal job, meaningful work, and great leadership—form an internal psychological scorecard for each employee relative to their employer. These factors also reflect the job upgrades and quality of life enhancements that continue to drive record amounts of turnover across a multitude of industries.

Contact The HR Team for expert advice and on-going support with your HR Strategy for 2024.

Is it time for an Equal Pay Review?

Businesses should regularly carry out equal pay reviews for several reasons; reflecting legal requirements, ethical considerations, and the promotion of a fair and inclusive workplace.

Key reasons:

• Equal Pay Legislation:

The UK has a legal framework, including the Equality Act 2010, that mandates equal pay for equal work. Employers are required to ensure that there is no gender pay discrimination in their organisations. Conducting equal pay reviews helps companies comply with these legal obligations.

• Gender Pay Reporting Requirements:

In addition to the general equal pay provisions, companies in the UK with 250 or more employees are required to report their gender pay gap annually. Conducting regular equal pay reviews assists companies in identifying and addressing any gender pay gaps, ensuring compliance with reporting requirements and addressing potential legal consequences.

• Legal Compliance and Risk Mitigation:

Failure to comply with equal pay legislation can result in legal challenges and financial penalties. Regular equal pay reviews help companies identify and rectify any pay disparities, reducing the risk of legal action and demonstrating a commitment to fair employment practices.

• Employee Morale and Engagement:

Ensuring equal pay contributes to a positive workplace culture, boosting employee morale and engagement. Employees are more likely to be motivated and committed when they perceive that they are being treated fairly in terms of compensation.

• Promotion of Diversity and Inclusion:

Equal pay reviews align with efforts to promote diversity and inclusion. By addressing pay disparities, companies contribute to creating a workplace where individuals from diverse backgrounds feel valued and included, enhancing overall organisational diversity goals.

• Reputation Management:

Companies that actively address and eliminate gender pay gaps are more likely to maintain a positive reputation. Reputation matters in attracting and retaining talent, as well as in appealing to socially conscious consumers and investors.

• Talent Attraction and Retention:

In a competitive job market, potential employees may consider a company’s commitment to equal pay as a factor in their decision to join the organisation. Likewise, existing employees are more likely to stay with a company that demonstrates a commitment to fairness and equality.

• Benchmarking and Improvement:

Regular equal pay reviews enable companies to benchmark their pay practices against industry standards and identify areas for improvement. This proactive approach allows organisations to continuously enhance their equal pay practices.

In summary, conducting equal pay reviews is not only a legal requirement but also a strategic and ethical practice. It helps companies uphold legal standards, foster a positive workplace culture, mitigate risks, and contribute to broader societal goals related to gender equality and diversity.

For practical support with an Equal Pay Review and help implementing an Equal Pay Policy, contact The HR Team for expert advice.

Largest ever National Minimum Wage Increase

The Government has announced that it has accepted the Low Pay Commission’s recommendations on minimum wage rates to apply from 1 April 2024. This is the largest ever increase to the minimum wage in cash terms.

For the first time, The National Living Wage will apply to all workers who are aged 21 and over (previously this only applied to people aged 23 and over).

The annual increases to the minimum wage and national living wage with effect from 1 April 2024 are as follows:

• 21 and over – £11.44 (increase of £1.02)

• 18-20 – £8.60 (increase of £1.11)

• 16-17 and apprentices – £6.40 (increase of £1.12)

These increases are effective from 1st April 2024, so it is important to review your employees’ salaries in February/March, so that you have time to communicate wage increases via Contract Amendment letters to any affected employees. Otherwise, you will need to backdate any necessary increases to 1st April, in order to avoid any future disputes around failing to pay the minimum wage.

For support with amending employee terms and conditions, including letter templates to communicate salary increases, contact The HR Team today.

November 2023

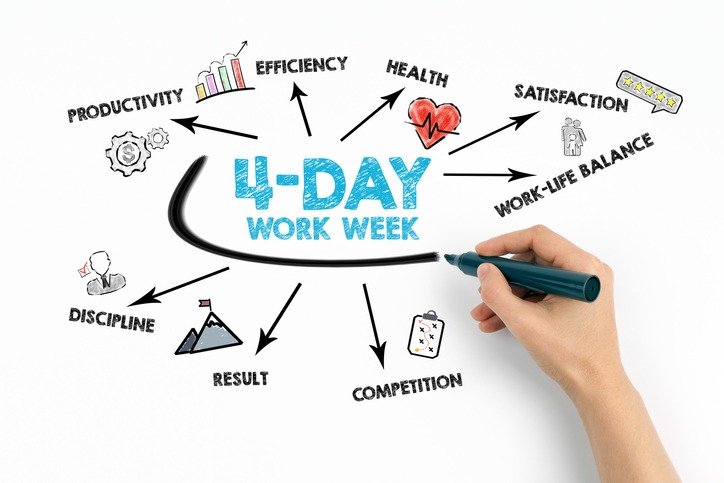

HR Insights November 2023 | The four-day working week: is it right for your business?

Working a four-day week: does it mean “less value for money” or is it the answer to improving employee wellbeing, commitment and retention?

The debate rumbles on, with valid points being made on both sides. In this month’s HR Insight, we take a look at the issue of the four-day working week, and what employers need to think about if trialling it in their own business.

In 2022, a major six-month trial of the four-day working week was carried out, whereby 61 organisations, totalling nearly 3000 employees, reduced their working days but maintained employee pay at 100%. Of those that took part:

• 92% continued with the trial

• 18% permanently adopted four-day week working

• 35% increased their revenue (compared to the same period in previous years)

• 57% reported higher retention rates than normal.

According to a survey conducted on the participants of the six-month trial, the following positive benefits were found of the four-day working week.

• 71% of employees had reduced levels of burnout by the end of the trial.

• 54% said they experienced fewer negative emotions.

• 46% reported a reduction in fatigue.

• 43% felt an improvement in their mental health.

• 40% saw a reduction in sleep difficulties.

• 39% were less stressed.

• 37% saw improvements in their physical health.

• 21% reported a reduction in childcare costs.

These positive results, along with a 2022 CIPD survey finding that 34% of organisations thought that the four-day week would become the norm within the next 10 years, suggest this could be the future for many organisations.

However, there are critics of this approach. In early July 2023, Local Government Minister, Lee Rowley, formally requested South Cambridgeshire District Council end its trial of a four-day week “immediately” over concerns about “value for money”, due to the potential impact it could have on the needs of local taxpayers. This is despite the council citing the trial as having a positive impact on its recruitment difficulties, enabling it to fill four previously impossible to fill permanent posts, reducing the council’s £2 million annual agency bill by £300,000.

So how can employers take advantage of the positives, whilst avoiding the potentially negative consequences of the four-day working week?

Planning and preparation are the keys to success –

For some businesses, moving towards a four-day working week will be relatively straightforward but nevertheless it will still be essential to get the buy-in of major stakeholders in the business. For organisations that are looking to start their own trial of a four-day working week, a detailed plan will be necessary to work out exactly how work will be organised and what efficiencies can be implemented.

Part of this planning is designing how the four-day week will look for the particular organisation. Some ways of arranging this type of working are:

• Fifth day stoppage – Shutting down operations for one day per week.

• Staggered – Alternating days off are taken by staff: one example is dividing staff into two teams with one team taking Mondays off and the other taking Fridays off.

• Decentralised – Allowing different departments to operate different work patterns.

• Annualised – Employees working a 32-hour average working week, calculated over a year.

This is especially useful for organisations where there is a seasonal fluctuation in trade. Individual organisations must decide which is the best option for them. Discussing this with employees and other key stakeholders in the business will be an important part of designing these plans.

Mitigating negative effects

Working shorter hours without reducing workloads raises an important question: how can employers mitigate the negative impact of this? Whilst an additional day off each week will offer many restorative benefits to employees, doing the same amount of work in a shorter time could lead to additional stress and pressure on individuals.

Key to mitigating the impact of this is to find innovative and practical ways of working smarter. This might include reviewing the frequency and content of meetings, automation, consolidating processes and introducing interruption-free time to allow those that need it time to focus on the task at hand without any distractions. Time should still be given, however, to working collaboratively and to forming and maintaining working relationships, to ensure the workplace culture does not turn “toxic” and the organisation remains a positive and sought-after place to work.

Measuring success

Before embarking on a trial of a four-day working week, the organisation needs to decide what “success” looks like for it and what markers will be used to decide whether or not to continue with the change permanently. What these will be will vary from businesses to business but some markers that might be used are:

• productivity

• performance

• employee satisfaction

• employee engagement

• employee recruitment and retention.

Only once the organisation has decided what success looks like can it begin to determine whether or not a four-day week is right for it.

Listen to feedback

Whatever the organisation has chosen to use as its measure for success, gathering and listening to feedback from the workforce will be an important part of assessing how well practically a four-day week will work for the organisation. What is going well, what is not and how that might be changed are all important insights as the business continues to fine-tune its working practices to adapt to four days, and ensures employees feel valued and listened to, and are therefore more likely to remain committed and loyal to the business.

Conclusion

A four-day working week is not for every business, however, as employers continue to face issues with recruitment and retention, for those that are able to do so, it may be worth considering. The principles of a four-day working week, however, can still be utilised even by employers not willing or able to commit to such a move. Focusing on efficiencies allowing for staff to use their time more wisely will be a benefit to many and could lead to an increased ability to approve flexible working requests in the future or even the possibility of “summer hours” where a reduced week is worked during peak summertime.

For more information regarding ‘The Four-day Week’ or any other HR assistance please contact The HR Team…

October 2023

HR Insights October 2023 Suspension and Investigation

Can an Employer suspend an employee, pending an investigation?

The simple answer is yes, you can suspend an employee pending an investigation, but it should be done for valid and justifiable reasons, and the process should adhere to established procedures and principles of fairness. Here are some key points to consider:

• Reasonable Grounds: To suspend an employee, there should be reasonable grounds for believing that suspension is necessary. Common reasons include allegations of serious misconduct, investigations into potential criminal activity, or the need to protect the interests of the business.

• Notice and Communication: You should inform the employee of the suspension in writing, specifying the reasons for the suspension and its expected duration. The suspension letter should also invite the employee to attend a meeting, often called an investigatory meeting.

• Pay during Suspension: Employees should typically continue to receive full pay and benefits during the suspension period. However, employers have the discretion to withhold additional payments such as commission and bonus payments in certain circumstances, such as in cases of gross misconduct.

• Regular Review: The suspension should be regularly reviewed to ensure it remains necessary. If it is no longer required, you should inform the employee and allow them to return to work.

• Fair Treatment: It is crucial to treat employees fairly and consistently during the suspension, following your organisation’s policies and procedures. Avoid prejudging the situation or creating an atmosphere of bias.

• Confidentiality: Both you and the employee should maintain confidentiality during the suspension to avoid prejudicing the investigation or disciplinary process.

• Legal and Policy Compliance: Ensure that your actions are in line with UK employment law, your organisation’s policies, and any applicable collective agreements.

Suspension and Investigation Procedure

The employee’s immediate Manager should suspend and hold the investigations. If possible, a different Manager or Director should hold the disciplinary meeting if & when it reaches that stage. Again, if possible, a further Director would hear the appeal to disciplinary meeting.

Suspension:

The employee should be called to an office and explained the reasons for the suspension and that a full investigation will commence immediately. Remind the employee that they are suspended on full pay and that all benefits are still in place.

Explain that this is a precautionary measure to allow a fair and impartial investigation to be carried out. Stress that this is no way prejudged and that the employee will have the opportunity to explain.

Give the employee the ‘Suspension Letter’ and let them know that their suspension will be regularly reviewed to ensure it remains necessary.

Investigation:

Gather as much information as possible, including any documentation from previous incidents.

Interview and take minutes from anyone that has been involved. Ensure that the investigating officer has a management representative with them and that the person being interviewed is given the opportunity to be accompanied if so wishes.

The employee has to be invited to an investigatory meeting so that any explanation can be heard.

‘Invite to Investigation’ to be sent out, giving at least 48 hours’ notice for the employee to prepare.

At the meeting ensure everything is in the minutes and that the employee is made aware of the process and where the employee and the Company is in the process.

Process:

• suspended on full pay

• investigatory meeting with people concerned with minutes taken

• other evidence i.e. reports etc.

• Investigatory meeting with the employee

Explain that the outcome of the investigation will be sent out to the Employee in writing once the outcomes have been collated and a decision has been made. If there is ‘a case to answer ‘in which case a disciplinary meeting will take place of which the employee will be informed and supplied with all the relevant documentation. However if there is ‘no case to answer’ then the employee will return to work.

Further guidance from The HR Team will be required once this stage is completed. All further letters will be drafted by The HR Team.

The next stage:

• letter sent to Employee stating the findings and outcome of the investigatory meeting

• If a there is a case to answer, letter to Employee inviting to a disciplinary meeting with copies of all evidence, reports and investigatory notes. (This enables the Employee to organise their defence)

Remember that suspension is a serious step and should not be used lightly. It’s essential to follow due process and act reasonably.

If you’re uncertain about whether to suspend an employee or how to proceed, contact The HR Team for down-to earth, pragmatic advice and dedicated support throughout the entire process.

September 2023

Don’t Punish Loyalty – Reward it!

The concept of “rewarding loyalty” in the context of employee compensation and retention is an important aspect of building a positive workplace culture and maintaining employee engagement.

Let’s explore this further…..

Salary Audits for Fair Compensation: Conducting company-wide salary audits is a proactive step towards ensuring that employees are paid fairly and equitably. When salaries are adjusted to match market rates and internal pay equity, it demonstrates the company’s commitment to treating its employees justly. Fair compensation is a foundational element in building trust within an organisation.

Consideration for Longevity: Recognising the contributions of long-serving employees is essential. These employees have likely accumulated a wealth of experience, institutional knowledge, and skills that benefit the company. When new employees are hired at higher rates, it’s important to consider the impact on the morale and engagement of existing employees who may be earning less. It’s not about punishing new hires but about valuing the loyalty and commitment of long-term staff.

Equalising Pay for the Same Role: When hiring externally for a role, it’s crucial to ensure that the salary offered to new hires matches or exceeds the pay of existing employees in the same position. This practice not only promotes fairness but also retains the existing talent pool by demonstrating that their loyalty and experience are valued. Failure to equalise pay can lead to resentment and potentially losing valuable employees.

Retention of Top Performers: Keeping your best employees feeling valued is a priority. High-performing employees are often the backbone of an organisation’s success. If they feel their loyalty and dedication are not recognised or rewarded, they may become disengaged or consider leaving the company. Recognising their contributions through competitive compensation, promotions, and other forms of recognition can motivate them to stay and continue to excel.

Building a Culture of Trust: Rewarding loyalty contributes to building a culture of trust within an organisation. When employees see that their dedication and commitment are acknowledged and rewarded, they are more likely to trust their employers and feel a sense of belonging. This, in turn, fosters a positive work environment where employees are motivated to contribute their best efforts.

In conclusion, the idea of “rewarding loyalty” is about recognising and valuing the commitment of long-serving employees and ensuring that they are fairly compensated and not left behind when new hires are brought in at higher rates. It’s a strategic approach to employee retention, engagement, and building a workplace culture based on trust and fairness. By implementing these practices, companies can create a more harmonious and productive work environment while retaining their top talent.

For further advice and support with salary auditing, contact The HR Team.

What is Parental Leave and how does it work?

Parental leave refers to the time off that eligible employees can take to care for their child or to make arrangements for the child’s welfare. Parental leave is different from maternity or paternity leave, as it is typically unpaid and can be taken by either parent.

Here are the key details about parental leave in the UK:

Eligibility: To be eligible for parental leave, employees must have at least one year of continuous service with their employer. Additionally, the child in question must be under the age of 18.

Duration: Each eligible employee is entitled to a maximum of 18 weeks of parental leave per child. This can be taken as a single block of leave or as separate periods, but each period of leave must be at least one weeklong, unless the child is disabled. The limit on how much parental leave each parent can take in a year is 4 weeks for each child (unless the employer agrees otherwise). A ‘week’ equals the length of time an employee normally works over 7 days.

Example: If an employee works 3 days a week, one ‘week’ of parental leave equals 3 days. If an employee works irregular weeks the number of days in a ‘week’ is the total number of days they work a year divided by 52.

Carrying leave over from a previous job:Parental leave applies to each child not to an individual’s job.

Example: An employee is entitled to 18 weeks. They’ve used 10 with a previous employer. They can use up to 8 weeks with their new employer if they’re eligible.

Notice: Employers usually require employees to give at least 21 days’ notice before taking parental leave. However, there may be exceptions in case of emergencies or exceptional circumstances.

Payment: Parental leave is unpaid. Employees are not entitled to receive their regular salary or wage during this time off.

Purpose: The primary purpose of parental leave is to allow parents to spend time with their child or to make arrangements for their child’s welfare. This can include activities like spending time with the child during school holidays or settling the child into a new childcare arrangement.

Multiple Children: If an employee has more than one child, they are entitled to parental leave for each child. However, the maximum total amount of leave remains at 18 weeks for each parent.

Protection from Dismissal: Employees are protected from dismissal or any detrimental treatment by their employer for taking or seeking to take parental leave.

Shared Parental Leave: The UK also has a separate system known as Shared Parental Leave (SPL), which allows eligible parents to share leave and pay in the first year after a child’s birth or adoption. This allows for greater flexibility in how parents choose to divide their time off work.

It’s important to note that parental leave is distinct from maternity leave (for mothers) and paternity leave (for fathers and partners), which have different eligibility criteria, durations, and payment structures. Employers and employees should be aware of their rights and responsibilities regarding parental leave and other forms of family-related leave, as these can vary based on individual circumstances and employment contracts.

For expert advice and support regarding Parental Leave, contact The HR Team.

How is Final Salary Calculated?

When an employee leaves a job, they are entitled to receive their final pay, which includes several components. The specific details can vary depending on factors like the employment contract, company policies, and the reason for the employee’s departure. Here are the key components of final pay when a contract of employment is terminated:

Salary or Wages: The final pay should include any salary or wages owed to the employee up to their last day of work. This includes the regular pay for hours worked, as well as any accrued but untaken annual leave, if applicable.

Notice Pay: If the employment contract requires a notice period, the employee is entitled to receive notice pay for the duration of the notice period. This is typically based on their regular salary or wages.

Outstanding Bonuses or Commissions: If the employee is entitled to any outstanding bonuses, commissions, or performance-related payments as per their employment contract or company policies, these should be included in the final pay.

Pension Contributions: If the employee is enrolled in a workplace pension scheme, the employer should continue to make contributions to the pension until the end of the notice period or until the last day of employment, depending on the terms of the scheme and the employment contract.

Statutory Redundancy Pay: If the employee is being made redundant and meets the eligibility criteria, they may be entitled to statutory redundancy pay. The amount is calculated based on the employee’s age, length of service, and weekly gross pay, subject to certain caps.

Benefits and Perks: Any outstanding benefits or perks, such as healthcare benefits, company car allowances, or share options, should be addressed in the final pay or separation agreement.

Return of Company Property: The employee will usually be required to return any company property, such as laptops, keys, access cards, or uniforms, as a condition of their departure. Deductions may be made from the final salary for any unreturned company property, as long as this is stated within the contract of employment.

Tax and National Insurance: Taxes and National Insurance contributions (including both the employee and employer portions) should be deducted from the final pay as per standard payroll procedures.

Holiday Pay: Any accrued but unused holiday pay should be included in the final pay. Employees may also have the option to take their remaining holiday days before leaving the job.

It’s important for both employers and employees to communicate openly and clearly about the terms of the final pay and any other details related to the departure. Employers should provide employees with a breakdown of their final pay, and employees should review it to ensure it aligns with their entitlements based on their employment contract, company policies, and statutory requirements.

Additionally, employers should issue a P45 form to the departing employee. This form provides information about the employee’s tax code and earnings to both the employee and HM Revenue and Customs (HMRC).

If there are any disputes or concerns regarding final pay, employees have the option to seek advice from ACAS (Advisory, Conciliation, and Arbitration Service) or consider legal action if necessary. Therefore, to avoid unnecessary disputes, it is important for employers to ensure each component of the final salary is considered and dealt with accordingly.

For help with final salary calculations, contact The HR Team.

August 2023

Holiday pay, TUPE and non-compete restrictions on former employees

In the wake of the UK Government’s reversal of its approach to EU legislation post-Brexit, important changes have been proposed to the rules on calculating holiday pay, TUPE and non-compete restrictions on former employees.

Context

The Government announced in May 2023 that instead of scrapping all regulations which came from EU law (which was planned to happen on 31st December 2023) it will take the opposite approach by keeping all of these regulations in force until it has time to review them. AT the same time, it has launched a consultation on reforming some of the least popular of those EU laws.

Here’s what’s happening

• Holiday Pay:

This is a hugely complex area which has been made more complicated in the last few years by case law coming out of both the EU and the UK courts. It is now proposed to simplify this by using a single rate of pay to calculate workers’ holiday pay and also to allow ‘rolled up holiday pay’ for workers who work sporadically such as casual workers.

• TUPE:

Smaller companies with less than 50 workers might not have to go through as much red tape when there’s a small transfer of work from one company to another.

• Non-compete clauses:

Changes are planned to limit the length of time some types of restrictive covenants (those which prevent employees from moving straight to a competitor of their employer) to 3 months after the termination of their employment. The intention of this is to keep the workforce moving and prevent employees from being restricted from moving between jobs in their sector.

When will these changes be implemented?

These changes are not likely to kick in until around 2024. But when they do, they will have significant impact. Employers who have been confused about holiday pay over the last few years might finally get some clarity, and those changes to non-compete rules could spark controversy.

Stay tuned at The HR Team for further updates on these and other important Employment Law changes.

How to ensure an effective Probationary Period for new employees

An effective probation period for employees typically ranges from 3 to 6 months, although the specific duration can vary based on the nature of the job, industry, and company policies. The primary purpose of a probation period is to evaluate the employee’s performance, suitability for the role, and cultural fit within the organisation before confirming their permanent employment.

Here are some key considerations to create an effective probation period:

1. Clear Expectations: Clearly communicate the job responsibilities, performance standards, and company values to the employee at the beginning of the probation period. Make sure they understand what is expected of them during this time.

2. Regular Feedback: Provide consistent and constructive feedback throughout the probation period. Regular check-ins, performance evaluations, and open communication help employees understand their strengths and areas for improvement.

3. Structured Evaluation: Establish a formal process for evaluating the employee’s performance at specific intervals during the probation period. This could include written assessments, goal-setting sessions, or performance reviews.

4. Training and Development: Offer necessary training, resources, and support to help the employee succeed in their role. Address any skill gaps or areas where improvement is needed.

5. Mentoring and Support: Assign a mentor or buddy to guide the new employee and answer their questions. This can help them integrate into the team more smoothly.

6. Realistic Timelines: Set achievable goals and expectations for the probation period. Avoid overwhelming the employee with an excessive workload or unrealistic targets.

7. Flexibility: Recognise that employees might take some time to adapt to the new role and company culture. Be open to adjusting expectations and providing additional support if needed.

8. Documentation: Keep thorough records of the employee’s performance, feedback, and any incidents during the probation period. This documentation can be valuable if a decision needs to be made regarding their permanent employment.

9. Clear Communication: Maintain open lines of communication with the employee to address any concerns, questions, or challenges they might have during the probation period.

10. Final Review: At the end of the probation period, conduct a comprehensive review to assess whether the employee meets the required standards for permanent employment. This decision should be based on a combination of their performance, behaviour, and cultural fit.

Remember that the probation period is a two-way evaluation process. It allows both the employer and the employee to assess whether the role and organisation are a good fit. Providing a structured and supportive probation period can lead to better long-term employee retention and performance.

For further support with ensuring you provide effective probation periods, contact The HR Team for expert advice.

How will AI impact HR?

AI is set to make a big impact on HR (Human Resources) in various exciting ways. As AI technology progresses, HR departments can tap into these innovations to boost their efficiency, decision-making, and overall effectiveness. Here are some key areas where AI will likely shape HR:

Finding the Best Fits

AI-powered applicant tracking systems (ATS) can swiftly sort through applications, matching job requirements with candidate qualifications. This helps HR teams identify top candidates and reduces bias in the hiring process.

A Helping Hand for New Employees

AI-driven chatbots and virtual assistants can be there for new employees, answering their questions and providing them with essential information during the onboarding process.

Data-Driven Insights

AI can crunch vast amounts of HR data, helping HR professionals make well-informed decisions and uncover valuable workforce trends.

Keeping Employees Happy

AI can gauge employee sentiment and satisfaction, allowing HR to address concerns and create a happier workplace.

Personalised Development

With AI, HR can tailor training programs to individual learning styles and performance, nurturing employee skills effectively.

Planning for the Future

AI algorithms can forecast talent needs based on business trends, making sure the right people are in the right roles when needed.

Simplifying HR Tasks

AI automation can handle routine HR chores like payroll, leave management, and benefits administration, freeing up HR professionals for more meaningful work.

Caring for Employee Well-being

AI tools can monitor employee stress levels and workloads, helping HR intervene and support employee well-being.

Promoting Inclusivity

AI can assist in identifying potential biases and fostering a more inclusive work environment.

While AI brings tremendous benefits to HR, it’s crucial to implement it thoughtfully, considering data privacy, transparency, and potential biases. With AI’s support, HR professionals can become more agile and strategic, contributing even more to their organisation’s success.

Visit the ‘Knowledge Base’ at The HR Team for more HR Insights and Newsletters.

July 2023

How to avoid an unfair dismissal claim

Preventing unfair dismissal claims requires employers to adhere to legal requirements and adopt fair and transparent practices when terminating an employee.

Here are 10 steps you can take to minimise the risk of unfair dismissal claims:

1. When dismissing an employee, always ensure you comply with all relevant legal requirements, including notice periods, termination reasons, and procedural fairness.

2. Have well-drafted employment contracts that clearly outline the terms and conditions of employment, including termination provisions. Implement comprehensive policies and procedures that address performance issues, disciplinary actions, and termination processes.

3. Set clear performance expectations for employees and provide regular feedback. Conduct performance reviews or appraisals to identify any concerns early on and offer opportunities for improvement.

4. Keep thorough records of any performance-related concerns, including written warnings, performance improvement plans, and instances of poor performance. Maintain detailed records of discussions and meetings related to performance issues.

5. Follow fair disciplinary procedures: If an employee’s conduct or performance falls below expectations, follow fair and consistent disciplinary procedures. Provide the employee with a clear understanding of the concerns, allow them to present their side, and offer support or training where necessary.

6. Unless there are serious breaches of employment terms, ensure you provide employees with the appropriate notice period or pay in lieu of notice as required by law or their employment contracts.

7. Consider alternative options before resorting to termination. This may include offering additional training or support, transferring the employee to a different role or department, or exploring performance improvement plans.

8. If termination is necessary, hold a termination meeting with the employee in a respectful and professional manner. Clearly explain the reasons for termination, provide relevant documentation and evidence, and allow the employee to express their views.

9. Follow legal requirements for redundancies: If termination is due to redundancy, ensure you follow the appropriate legal requirements, including consultation processes, selection criteria, and providing redundancy pay where applicable.

10. Seek legal advice if uncertain: If you have concerns or uncertainties about the termination process, contact The HR Team. We can provide guidance based on specific circumstances and walk you through a fair process, to ensure you remain legally compliant and avoid a potential unfair dismissal claim.

Do employees have to disclose medical conditions to their employer?

The short answer is No. An employee is not legally obliged to disclose a medical condition, whether mental or not, to their employer.

Discussing medical conditions, particularly mental illness, is a very personal matter which many find very difficult to share. However, there are several ways an employer can help create an honest, inclusive and supportive environment for all employees.

Here are some steps you can take:

1. Respect employee privacy: Employees have the right to privacy regarding their medical information. Unless the medical condition directly affects their ability to perform the job safely and effectively, employers should generally not delve into an employees medical history without their consent.

2. Create a supportive environment: Foster a workplace culture that encourages open communication and trust. Encourage employees to disclose any medical conditions or disabilities voluntarily, via a health questionnaire, assuring them that the information will be kept confidential and used only for reasonable adjustments and support.

3. Educate employees about disclosure: Provide information and training to employees about the importance of disclosing any medical conditions that may impact their ability to perform their job safely. Emphasise that disclosure enables the employer to make reasonable adjustments and ensure the employees well-being.

4. Review policies and procedures: Ensure your policies and procedures clearly outline the expectations regarding disclosure of medical conditions. Communicate these policies to employees and provide them with the necessary channels to disclose any conditions or seek reasonable adjustments.

5. Interactive process for reasonable adjustments: If an employee later discloses a medical condition that requires reasonable adjustments, engage in an interactive process. Work with the employee to understand their needs and explore possible reasonable adjustments that will enable them to perform their job effectively.

6. Assess undue hardship: While employers have a legal obligation to provide reasonable adjustments, there may be cases where an adjustment would cause undue hardship to the organisation. Assess the feasibility and impact of potential adjustments, considering factors such as cost, resources, and the nature of the job.

7. Seek HR advice: If you are unsure about your obligations or the appropriate course of action when an employee does not disclose a medical condition, consult with HR to ensure compliance with relevant UK laws and regulations.

It’s important to approach the situation with sensitivity, respecting employee privacy while balancing the need for a safe and productive work environment. Open communication, clear policies, and a supportive approach can encourage employees to disclose any medical conditions and work collaboratively to find appropriate reasonable adjustments when needed. Contact The HR Team for further advice and support.

Will expanding funded childcare get people back to work?

Childcare in the UK is among the most expensive in the world. Research indicates that many people (and evidently more women) are dropping out of the workforce as a result, but whose responsibility is it to solve the problem?

The Government revealed in its Spring Budget, that one of their plans is to support parents in returning to the workforce by extending free childcare hours for working parents in England to include all children aged from 9 months to 5 years by September 2025. The Government currently funds 30 hours of childcare per week for eligible 3–4-year-olds.

A related issue is The Gender Pay Gap, which shows the difference in average earnings between men and women. It doesn’t just cover what people get paid it also covers how many women there are, what roles they hold, and how they are progressing up the ranks. The BBC recently reported that the gap has not improved since the reporting requirements were introduced and cited the pandemic and childcare costs as the main factors.

Spiralling childcare costs is having an impact on people, particularly women, working. For many women, it is more affordable to leave work and look after their children than pay for childcare. This impacts on the gender pay gap, with motherhood becoming the most significant driver for this with women leaving their jobs. Along with the cost-of-living increase, especially for families on lower income levels, it becomes a real number crunching exercise, where even with all the will in the world to want to keep working, financially it simply isn’t viable.

The challenge for employers tends to be keeping women in their roles. If women are leaving their jobs in order to look after their children due to childcare costs, how do employers encourage them to stay in the workplace?

Companies could use initiatives such as:

- Offering more flexible working opportunities for parents.

- Encouraging the take up of parental leave policies and entitlements and enhance statutory benefits so it is more affordable to do so.

- Offer financial assistance such as swapping out unused benefits for a cash equivalent to help fund childcare.

- Encourage employees to make use of the Government’s Tax Free Childcare Scheme which has now replaced the old Childcare Vouchers Scheme.

In order to help tackle the widening Gender Pay Gap, other schools of thought suggest getting more women/girls to take up STEM subjects (Science, Technology, Engineering and Mathematics) to encourage more females in the workforce and to tackle unconscious bias around traditional male/female roles and responsibilities.

For further help and advice around the parental benefits your company could offer to help with employee retention, contact The HR Team.

April 2023

HR Insights | April 2023

Improve Business Productivity

How to engage your employees, both at the office and from home

Any successful business or project requires a great plan and talented, hardworking people to make it happen. But workplace productivity, the ultimate effectiveness of your efforts, greatly influences how far and fast you can go. To maximise productivity, you need a clear plan for what and how things need to happen to achieve a certain goal.

Prioritising a productivity strategy takes time, patience and flexibility. From KPIs to motivation and even physical wellness, there are many ways to be more productive.

What can a business do to improve its productivity?

Business productivity is directly related to how engaged a person is with their work and their employer. People tend to work harder when someone is watching and showing appreciation for their efforts. It’s up to managers and company leaders to create an environment that’s motivating enough to keep people focused.

This has become especially important with remote work. It’s critical to develop plans that engage employees both at the office and from home. The more you can capture the attention and interest of your team, the better shot you have at boosting productivity.

10 ways to improve business productivity

Without a clear blueprint for success, no company can keep its employees consistently productive. Here are 10 of the top tips for maximising effectiveness:

1. Keep things simple

While having a productivity strategy is key, it doesn’t have to be elaborate. Creating a simple, focused plan with clear steps and outcomes helps people stay on task and sets them up for success. Map out SMART objectives with simple, achievable deliverables so everyone knows exactly what to do.

2. Set reminders

Use a cloud-based HR Software such as breatheHR to remind line managers what needs to be done on specific days, so your brain doesn’t have to. Set objectives for your team then have individuals set their own deliverables to encourage engagement and accountability.

3. Review objectives regularly

Setting objectives is one of the most important parts of any business strategy. But they mean nothing if they aren’t consistently being reviewed and revised. After establishing clear objectives, make sure everyone has a way to check progress regularly. If daily or weekly doesn’t make sense in a given scenario, set realistic expectations, like sending monthly progress summaries.

4. Minimise time-wasting activities

Whether at home or in the office, countless things can steal our attention away from work. Successful managers know this and devise ways to combat the worst of them. Here’s how to avoid some common productivity killers:

• Meetings: Limit the number of meetings you have and who attends them. If a meeting is absolutely necessary, it should have a clear, focused agenda, time limits by topic and end as soon as there’s a resolution.

• Emails: There are many faster ways to get or share information than email. Send a quick TEAMS chat message, launch an impromptu video call or (gasp) pick up the phone. Connecting directly through real-time tools is almost always more efficient.

• Co-workers: While you always want a good rapport with colleagues, there’s a time and place for personal conversations. Provide opportunities for people to have lunches together, offer video happy hours, create topical chat channels and encourage other activities to connect outside of work time

.

• Lack of organisation: Disorganisation forces people to waste time looking for what they need (see: 5,000-email inbox). Beyond clean desks and well-labelled folders, organising digital workflows can dramatically increase productivity. For example, managing teams through Slack allows you to search conversations by channel, share files within projects, pin important docs for faster access and launch meetings all in one place.

• Social media: The average person spends around two and a half hours per day on social media platforms. Have a policy in place that clearly states when it’s OK to use social media and when to focus on work.

• Procrastination: We all do it. The best way to prevent it is through clearly stated deadlines and accountability. Every person who has a due date for their project should have someone following up with them, ensuring that the target is met.

5. Use Productivity Apps

Technology can be our biggest help and our biggest distraction. When used for good, apps can significantly boost business productivity. Some of the most popular productivity apps include:

• Toggl

• Slack

• Dropbox

• Todoist

6. Motivate Your Team

One of the most difficult (and important) business growth strategies is keeping your team members motivated. The “how” might be different for just about anyone you ask. So it’s crucial to have a clear understanding of what’s most important to each person you work with.

Finding a balance between intrinsic and extrinsic motivation is key to reaching the productivity sweet spot. Intrinsic motivation promotes self-reflective benefits that make a person want to be successful for no other reason than their own personal satisfaction. On the flip side, extrinsic motivation provides external rewards for good behaviour and reaching goals, like additional annual leave days or a social event.

7. Avoid Multi-tasking

Many people claim to be great multitaskers, but in reality, it’s almost always better to work on one thing at a time. Multiple studies have shown that multitasking can negatively affect individual productivity by as much as 40%. At a bare minimum, make sure team members have a relatively equal workload. Delegate tasks by who’s best at them or willing to take them on (versus always by role or title). Setting realistic expectations also minimises the need to juggle too many things at once or to put in minimal effort.

8. Offer a Wellness Program

Wellness encompasses physical and mental health, both of which can improve productivity. Research shows that people with good mental health those who are physically active on a regular basis tend to be more productive at work.

Benefits like vouchers for complimentary therapies, health screenings or on-site fitness equipment are great strategies that help teams improve their overall productivity by focusing on the whole person.

9. Avoid Burnout

Employee burnout is a real problem across every industry. It leads to procrastination, lack of motivation and even injury and illness. Holidays can improve physical health, mental wellness, cognitive function and relationships.

Encourage breaks and holidays to keep minds fresh. Offer remote work options to cut down on commute fatigue. There are so many ways to maintain strong communication with your remote team while improving business productivity.

10. Hold regular one-to-one meetings

It’s hard for some people to openly communicate and share their ideas in the workplace, whether with their manager or their peers. Encourage regular one-to-one catchups so that it becomes part of the company culture. To foster inclusion, set up collaborations with members of your teams. Schedule regular in-person meetings or video chats to discuss workload, goals and struggles with the mission of improving overall performance and experience.

Which strategy will help your team improve business productivity?

Ultimately, better productivity starts with business leaders providing achievable frameworks for success. It’s important to figure out what motivates teams and individuals, from setting reminder notifications and discouraging multitasking to offering generous annual leave and wellness programs.

If you need help improving your business productivity, contact The HR Team for expert support and advice.

March 2023

HR Insights | March 2023

Equality, Diversity and Inclusion (EDI) in the Workplace

Promoting and delivering EDI in the workplace is essential. It’s about creating working environments and cultures where every individual can feel safe, a sense of belonging and is empowered to achieve their full potential. 2020 was a big, difficult, important year and times have most certainly changed.

2020 brought many issues to the forefront of our collective consciousness. The global Black Lives Matter movement had a huge impact, from a social to a corporate level. Discussions of sexual harassment around the #MeToo movement. COVID-19 and the remote working boom triggered a global discussion about the distribution of home and workplace labour between male and female employees.

Although working from home can have great benefits for working parents, the numbers are showing that the pressure being put on women is disproportionate. Mothers are three times as likely as fathers to be responsible for most of their family’s housework and childcare during COVID-19, leading over 25% of women to consider downsizing their careers. The gender pay gap also endures with the UN estimating that the gap stands at 23% globally.

NEW statistics are sending a clear message about what employees want. According to a 2021 Glassdoor survey, 76% of employees and job seekers report a diverse workforce is an important factor when evaluating companies and job offers. This is a true indicator that times are changing.

Equality Act 2010